When it comes to borrowing money, it’s important to understand the key distinctions between secured and unsecured loans. These two types of loans have different requirements and terms, and can significantly impact your financial situation. Whether you’re planning to take out a personal loan, a mortgage, or a business loan, knowing the differences between secured and unsecured loans will help you make an informed decision.

What are Secured Loans

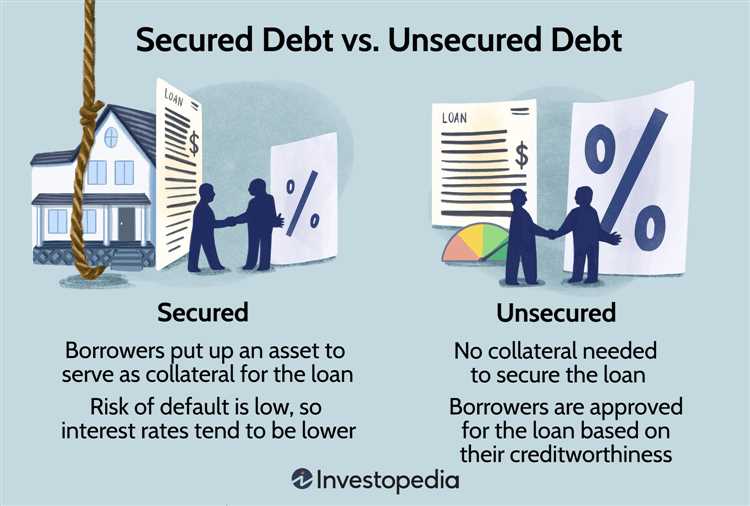

Secured loans are loans that are backed by collateral, which is an asset that the borrower pledges as security for the loan. This collateral can come in various forms, such as a home, car, or other valuable property. By providing collateral, the borrower reduces the risk for the lender, making it easier to secure the loan. If the borrower fails to repay the loan, the lender has the right to take possession of the collateral and sell it to recover their losses.

Secured loans generally come with lower interest rates compared to unsecured loans because there is less risk for the lender. Lenders are more inclined to provide secured loans because they have a higher chance of recouping their investment. The loan amount for a secured loan is usually based on the value of the collateral provided by the borrower.

Examples of secured loans include mortgages, auto loans, and home equity loans. These types of loans are often used for large purchases or to consolidate debt. Due to the collateral requirement, secured loans are typically easier to obtain for borrowers with lower credit scores or less-established credit histories.

Benefits of Secured Loans

Secured loans offer several advantages compared to unsecured loans:

1. Lower interest rates: Since secured loans are backed by collateral, lenders are more willing to offer lower interest rates. This is because they have a way to recover their money if the borrower defaults on the loan.

2. Higher borrowing limits: Secured loans usually have higher borrowing limits compared to unsecured loans. Lenders are more comfortable lending larger amounts of money when they have collateral to fall back on.

3. Longer repayment terms: Secured loans often come with longer repayment terms, making it easier for borrowers to manage their monthly payments. This can be especially beneficial for larger loan amounts, as it allows borrowers to spread out their payments over a longer period of time.

4. Easier qualification: Secured loans are generally easier to qualify for compared to unsecured loans. Lenders are more willing to lend to individuals with less-than-perfect credit histories as long as they have valuable collateral to secure the loan.

5. Access to better deals: Having collateral can give borrowers access to better loan deals and lower fees. Lenders may be more willing to negotiate better terms and conditions when they have an asset to secure the loan.

Overall, secured loans can provide borrowers with more favorable terms, lower interest rates, and higher borrowing limits, making them a popular choice for individuals looking for larger loan amounts or with less-than-perfect credit.

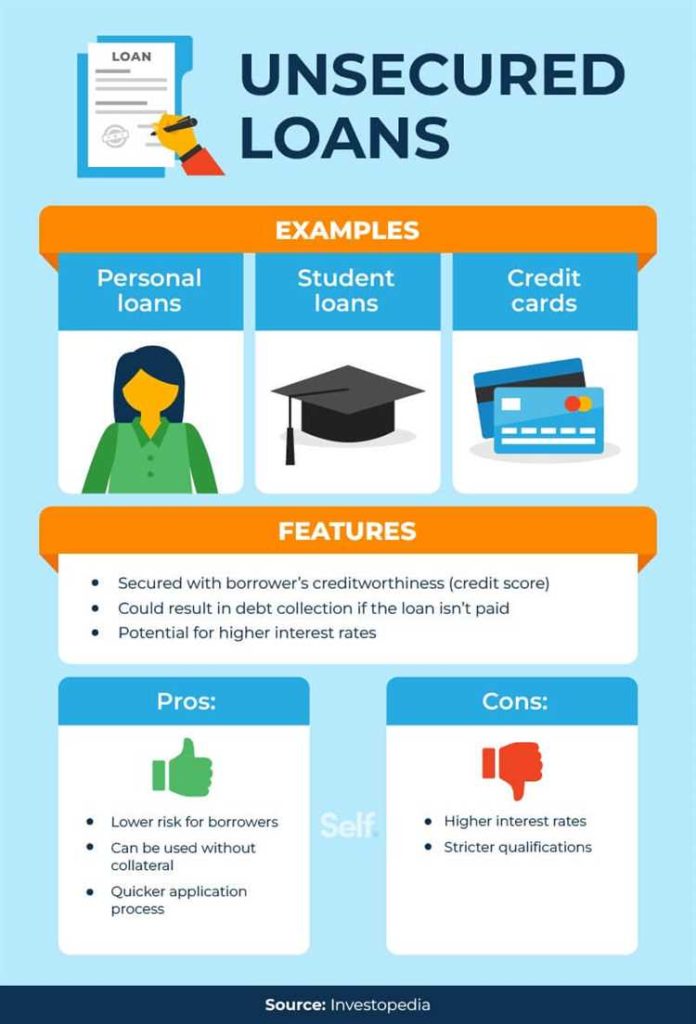

What are Unsecured Loans

Unsecured loans, also known as personal loans or signature loans, are loans that are not backed by collateral. This means that the borrower does not have to put up any assets, such as a home or car, as security for the loan.

Unsecured loans are typically based on the borrower’s creditworthiness and ability to repay the loan. Lenders will assess the borrower’s credit score, income, employment history, and other factors to determine whether they are eligible for an unsecured loan.

Because there is no collateral involved, unsecured loans generally have higher interest rates than secured loans. Lenders view unsecured loans as riskier, as they have no way to recoup their losses if the borrower defaults on the loan.

Unsecured loans can be used for a variety of purposes, such as debt consolidation, home improvements, medical expenses, or unexpected emergencies. Borrowers have more flexibility in how they use the funds, as there are no restrictions on the specific use of the loan.

Difference between Secured and Unsecured Loans

When borrowing money, it’s important to understand the differences between secured and unsecured loans. These two types of loans have distinct characteristics and can impact your financial situation in different ways.

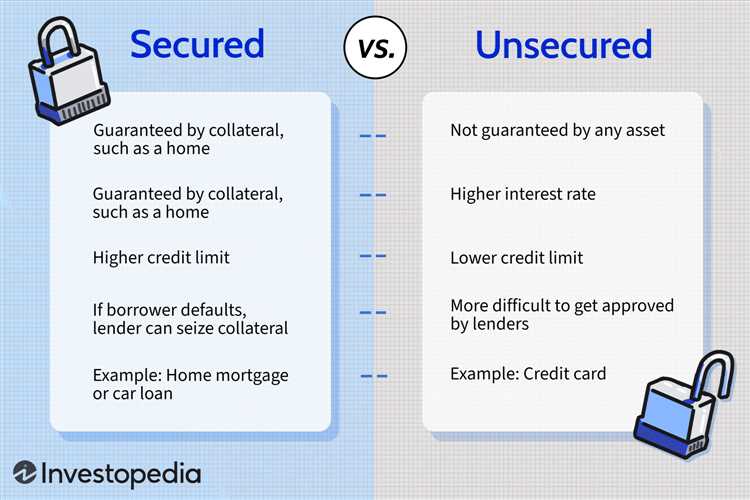

Collateral: One of the major differences between secured and unsecured loans is the presence of collateral. Secured loans require borrowers to provide an asset as collateral, such as a house or a car. This collateral acts as security for the lender, reducing the risk of non-payment. In contrast, unsecured loans do not require any collateral, making them a riskier option for lenders.

Interest Rates: Another key distinction between secured and unsecured loans is the interest rates. Secured loans generally come with lower interest rates compared to unsecured loans. This is because lenders have the collateral to fall back on if the borrower defaults on the loan. On the other hand, unsecured loans carry higher interest rates to compensate for the increased risk to the lender.

Loan Amount: The loan amount also differs between secured and unsecured loans. Secured loans typically offer higher loan amounts since there is collateral backing the loan. Lenders are more willing to extend larger amounts of credit when there is a valuable asset involved. In contrast, unsecured loans usually have lower lending limits due to the higher risk involved for the lender.

Approval Process: The approval process for secured and unsecured loans can also vary. Secured loans may require more paperwork and documentation, as the lender needs to assess the value and condition of the collateral. Unsecured loans may have a simpler approval process since there is no collateral involved, but lenders may require additional checks to determine the borrower’s creditworthiness.

Default Consequences: Lastly, the consequences of defaulting on a secured or unsecured loan differ. If a borrower defaults on a secured loan, the lender has the right to seize the collateral and sell it to recover their losses. In the case of unsecured loans, lenders may take legal action or engage collection agencies to recover the debt, but they do not have direct access to any collateral.

Disadvantages of Secured Loans and Unsecured Loans

While both secured and unsecured loans have their advantages, they also come with their fair share of disadvantages.

| Secured Loans | Unsecured Loans |

| 1. Risk of asset seizure: With secured loans, if the borrower fails to repay the loan, the lender has the right to seize the collateral used to secure the loan. This can result in the loss of the valuable asset. 2. Limited options for borrowers: Secured loans are typically offered by banks and financial institutions, meaning that borrowers may have limited options when it comes to obtaining this type of loan. 3. Longer approval process: Secured loans often require a more extensive approval process, including property appraisal and documentation, which can result in longer processing times. | 1. Higher interest rates: Unsecured loans often come with higher interest rates compared to secured loans because lenders take on a greater risk by not having any collateral to secure the loan. 2. Limited loan amounts: Unsecured loans typically have lower loan amounts compared to secured loans, as the absence of collateral makes lenders more cautious about lending larger sums of money. 3. Stringent eligibility criteria: Lenders offering unsecured loans often have stricter eligibility criteria, such as higher credit score requirements and income verification, making it more difficult for certain individuals to qualify. |

Choosing between Secured and Unsecured Loans

When it comes to borrowing money, it’s important to understand the key differences between secured and unsecured loans before making a decision. Each type of loan comes with its own set of advantages and disadvantages, and the right choice will depend on your specific financial situation and needs.

A secured loan is backed by collateral, such as a car or a house, which the lender can seize if the borrower fails to repay the loan. This type of loan generally offers lower interest rates and higher borrowing limits compared to unsecured loans, making it a popular choice for those with valuable assets who are confident in their ability to make timely repayments.

On the other hand, an unsecured loan does not require collateral and is based solely on the borrower’s creditworthiness. While unsecured loans may have higher interest rates and lower borrowing limits, they offer the advantage of not putting valuable assets at risk. This makes them a suitable choice for borrowers who don’t have assets to use as collateral or who don’t want to put their assets on the line.

Before choosing between secured and unsecured loans, it’s important to consider your financial situation, income stability, and credit history. If you have a stable income and a good credit score, you may qualify for better interest rates and terms on an unsecured loan. However, if you have valuable assets and are confident in your ability to repay the loan on time, a secured loan may be a more affordable option.

| Secured Loans | Unsecured Loans |

| Requires collateral | No collateral required |

| Lower interest rates | Higher interest rates |

| Higher borrowing limits | Lower borrowing limits |

| Asset at risk if loan is not repaid | No assets at risk |

Ultimately, the choice between a secured and unsecured loan will depend on your individual circumstances and priorities. It’s important to carefully consider your financial situation and goals before making a decision, and to seek advice from a financial professional if needed.

Conclusion

Understanding the differences between secured and unsecured loans is crucial when making financial decisions. It’s important to carefully consider your own financial situation and goals before choosing the type of loan that best suits your needs. Whether you opt for a secured loan with lower interest rates but the risk of losing collateral, or an unsecured loan with higher interest rates but more flexibility, make sure to weigh the pros and cons and choose wisely.

What is a secured loan?

A secured loan is a type of loan that is backed by collateral. This means that if the borrower fails to repay the loan, the lender can take possession of the collateral to recover their money.

What is an example of a secured loan?

An example of a secured loan is a mortgage. In a mortgage, the house acts as collateral, and if the borrower defaults on the loan, the lender can foreclose on the property to recoup their losses.

What is an unsecured loan?

An unsecured loan is a type of loan that is not backed by collateral. This means that the lender does not have any assets to seize if the borrower fails to repay the loan.

What are the key differences between secured and unsecured loans?

The key difference between secured and unsecured loans is that secured loans require collateral, while unsecured loans do not. Additionally, secured loans generally have lower interest rates and higher borrowing limits compared to unsecured loans.

Leave a Reply